3 - DIVISION B - Computation of Income. Part 2 Basic provisions.

Income Tax Case Laws Set Off Carry Forward Of Losses Section 70 To 80 Income Tax Act

Income Tax Act No.

. As laid down in the Notification No. Officer may appear on prosecution. Chapter 1 Charges to income tax.

Overview of Income Tax Acts. 8A Tax on Updated Return as per Section 140B of Income Tax Act 1961 Introduction The Finance Act 2022 provided an. Check out excel calculators budget 2017 ITR black money tax saving tips deductions tax audit on income tax.

Return of dividends paid Omitted. Application of Information Technology. 332 RE 2019 9 _____ CHAPTER 332 _____ THE INCOME TAX ACT An Act to make provisions for the charge assessment and collection of Income Tax for the ascertainment of the income to be charged and for matters incidental thereto.

Return of interest paid Omitted Rule 117. Compilation of Social Security Laws 1903. Penalties leviable under the Income-tax Act.

Income Tax Case Laws Section Wise containing decisions of Supreme Court High Court Tribaul CESTAT CEGAT AAR Advance Ruling Authority etc. The Income Tax Act CAP. Tax on income referred to in section 68 or section 69 or section 69A or section 69B or section 69C or section 69D.

A of this section and limits its membership to the members of a particular religion or to a club which in good faith limits its membership to the. Form of notices returns etc. The Scottish basic.

YouTube Income Rich Life Career. 655 Chapter XII-A-Special Provisions Relating to Certain Incomes of Non-Residents. GST Section List in PDF Format.

2 It extends to the whole of. Chapter 2 Rates at which income tax is charged. 11 of 2004 15 of 2004 13 of 2005 6 of 2006 16 of 2007 1 of 2008 13 of 2008 14 of.

Of this section is exempt from income tax under subsec. 104127 title VII 780 Apr. Service of notice summons requisition order and other communication.

653 SECTION 115BBG. 2 - DIVISION A - Liability for Tax. This Act may be called The Income-tax Act 1961.

Income Tax 7 Issue 1 Section 116. Loading of goods destined for export on foreign-going vessels and aircraft and cross-border railway carriages114. Orders permissible following conviction of person of offence contemplated in section 2 2.

Service of notice summons requisition order and other communication. Penalty for default in making payment of Self Assessment Tax As per section 140A1 any tax due after allowing credit for TDS advance tax etc along with interest and fee should be paid before filing the return of income. Tax on income from transfer of carbon credits.

Federal laws of canada. Section 127 Power to impose penalty in certain cases. Post getting recognition a Startup may apply for Tax exemption under section 80 IAC of the Income Tax Act.

2 - PART I - Income Tax. Tax on income from patent. GST Section 2022.

Get all latest income tax news act article notification circulars instructions slab on Taxguruin. Section 311 of the Act was classified to section 940a of Title 7 prior to repeal by Pub. 1 - Short Title 2 - PART I - Income Tax 2 - DIVISION A - Liability for Tax 3 - DIVISION B - Computation of Income 3 - Basic Rules 5 - SUBDIVISION A - Income or Loss from an Office or Employment 5 - Basic Rules 6 - Inclusions 8 - Deductions 9 - SUBDIVISION B - Income or Loss from a Business or Property 9 - Basic Rules.

Tax rates for individuals estates and trusts for taxable years after 1994. The Income Tax Department NEVER asks for your PIN numbers. Rate of exchange for conversion of rupees into foreign currency and reconversion of foreign currency into rupees for the purpose of computation of capital gains under the proviso to clause a of sub-section 1 of section 48 of the Income-tax Act 1961.

Tom Cruise Net worth 2022. PROSECUTION AGAINST AN ASSESSEE UNDER INCOME TAX ACT 1961 WHEN THE AS. Income tax an annual tax.

Furnishing of statement of financial transaction. Salary Earnings Assets Biography. 127 E dated 19022019 issued by Department for Promotion of Industry and Internal Trade DPIITthe following will be considered as a Startup -.

List of all sections of GST Act with Analysis Sections of Goods and Service Tax Act 2017 01 June 2021. 1396b From the sums appropriated therefor the Secretary except as otherwise provided in this section shall pay to each State which has a plan approved under this title for each quarter beginning with the quarter commencing January 1 1966an amount equal to the Federal. Basic rate higher rate and additional rate.

C for the purposes of applying sections 37 65 to 664 667 111 and 126 subsections 1275 to 36 and section 1273 to the person the person is deemed to be a new corporation or trust. 1 - Short Title 2 - PART I - Income Tax 2 - DIVISION A - Liability for Tax 3 - DIVISION B - Computation of Income 3 - Basic Rules 5 - SUBDIVISION A - Income or Loss from an Office or Employment 5 - Basic Rules 6 - Inclusions 8 - Deductions 9 - SUBDIVISION B - Income or Loss from a Business or Property 9 - Basic Rules 12 - Inclusions 18 - Deductions 22 - Ceasing. A For taxable years beginning after 1994 a tax is imposed on the South Carolina taxable income of individuals estates and trusts and any other entity except those taxed or exempted from taxation under Sections 12-6-530 through 12-6-550 computed at the following rates with the income.

List of sections or provisions. Post getting clearance for Tax exemption. Additional Director means a person appointed to be an Additional Director of Income-tax under sub-section 1 of section 117 2 annual value in relation to any property.

Attachment of property of petitioner. 1 - Short Title. Offences by corporate bodies.

This Act may be cited as the Income Tax Act 1973 and shall subject to the Sixth Schedule come into operation on 1st January 1974 and apply to. Overview of charges to income tax. Tax paid as per section 140A1 is called self-assessment tax.

Income tax and companies. 653 SECTION 115BBF.

Change Of Assessing Officer And Jurisdiction For Income Tax Sid Associates

3 224 Likes 12 Comments Mochi Studies On Instagram Holidays Aren T Holidays With Hand Lettering Worksheet School Organization Notes Notes Inspiration

Income Tax Income Tax Income Tax

How To Track Gst Registration Application Status In Overview Status Application Pre And Post

Maldives In Imf Staff Country Reports Volume 2019 Issue 196 2019

2018 Money Flow From 26 Year Old Male Oc Dataisbeautiful Data Visualization Information Visualization Visualisation

Foreign Income Tax Malaysia Removal Of Exemptions

Section 282a Of Income Tax Issue Of Income Tax Notice Indiafilings

Pin By The Taxtalk On Income Tax In 2021 Income Tax Taxact Income

Penalties Under Income Tax Act 1961

No Dissolution Clause In The Trust Deed Whether Registration U S 12ab Can Be Denied The Proposition Taxact Clause

Solution For Dsc Trouble Shooting On Gst Website Https Taxguru In Goods And Service Tax Solution Dsc Trouble S Solutions Goods And Service Tax Indirect Tax

Section 142 1 Of Income Tax Act Inquiry Before Assessment Of Tax Tax2win

What Are The Benefits Available For Start Ups Under The Income Tax Act Taxmann Blog

25 Key Income Tax Case Laws Of The Year 2021 Taxmann Com

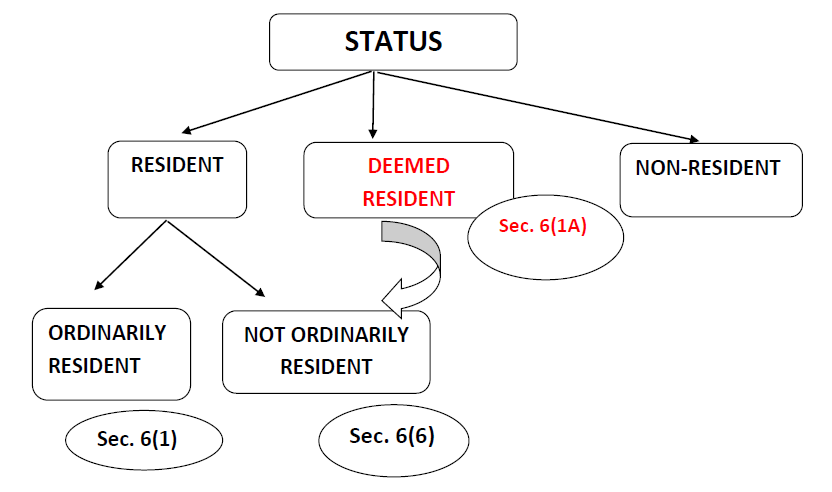

Nri Status For Financial Year 2020 21 New Circulars Sbnri